Real Estate—Outright Gift

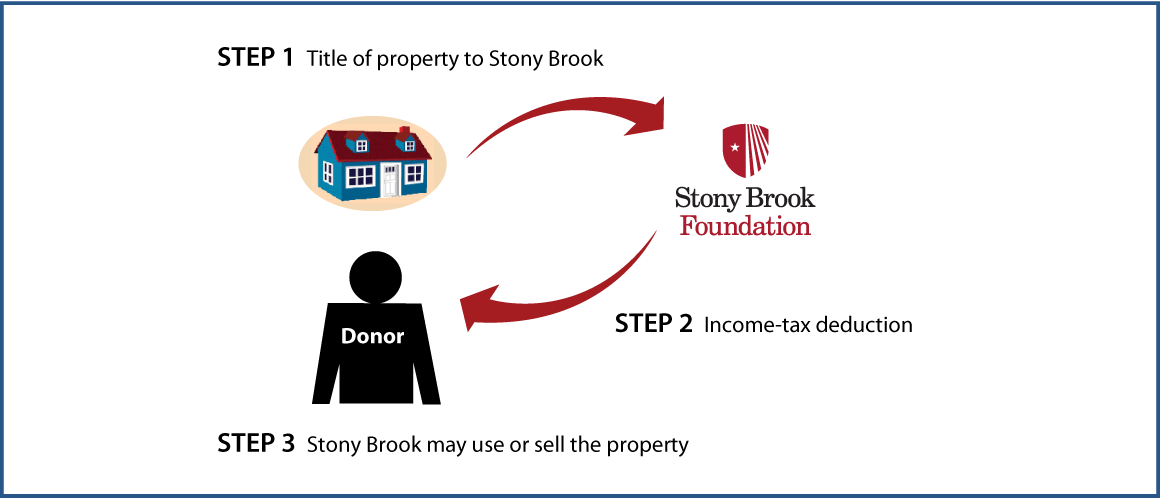

How It Works

- Transfer title of property to Stony Brook

- Receive income-tax deduction for fair-market value of property

- Stony Brook may use or sell the property

Benefits

- Income-tax deduction for fair-market value of property based on qualified appraisal

- Avoid capital-gain tax on appreciation in value of the real estate

- Relieved of details of selling property

- Significant gift to Stony Brook

Request an eBrochure

Request Calculation

Contact Us

Shawn T. Mroz

Executive Director of Gift Planning

shawn.mroz@stonybrook.edu

(631) 632-4788

Stony Brook University

Office of Gift Planning

(631) 632-4413

gift.planning@stonybrook.edu

© Pentera, Inc. Planned giving content. All rights reserved.

Disclaimer